3 Customer Acquisition Shortcuts Stunting Your Growth

When it comes to building your eCommerce strategy, we’re big proponents of taking a Customer Lifetime Value (CLV) approach.This entails understanding who your most profitable customers are and then focusing marketing spend on acquiring more just like them. How successfully you manage to implement this strategy will hinge upon your ability to embrace granularity!

It’s all too easy to take shortcuts on your mission to acquire high-value customers. Some marketers dodge granularity by sticking to “straightforward” metrics such as cost of sale, while others wash away valuable nuance in favour of a tidier (and far less accurate) average CLV. The first marketer tends to spend conservatively, acquiring a lot of one-and-done customers. Meanwhile the second optimises for mediocrity, underspending on valuable customers and overspending on the rest. Clearly neither of these approaches are ideal.

This blog will introduce the key concepts of CLV, helping you to identify and avoid the shortcuts that may be stunting your business’ growth. Armed with this knowledge you will understand where your budget is being wasted and exactly how you need to shift your strategy in order to get better returns.

What you need to know about CLV

Customer lifetime value refers to the amount of money a customer will bring your brand throughout their entire time as a paying customer. Although do take the term “lifetime” with a grain of salt. As it’s impractical to wait a lifetime, focus instead on a period of 1-3 years.

As a marketer there are many metrics you need to keep on top of, from average order value to repeat purchase rate. They all serve important purposes. CLV however is arguably one of the most important metrics for informing and driving your entire customer lifecycle. But there is a right way and a wrong way to calculate this metric. By always remembering these key tenets you can avoid falling into such miscalculations:

- Don’t treat all customers the same – The Pareto principle (known as the 80:20 rule), stipulates that 80% of value is generated from 20% of a customer base. In our experience with eCommerce brands, we find the average concentration of value to be 55% of value derived from 20% of customers. Regardless, with this in mind it would be foolish to use averaged customer metrics to inform your customer acquisition strategy. This would only be effective if all customers exhibited the same purchase behaviour irregardless of location, channel, device, season etc.

- Do treat historic data as stale – When it comes to your recently acquired customers, all previous measures of customer value should be treated as outdated. A stark example of unreliable historic appraisals can be seen with the COVID pandemic, which dramatically shifted consumer behaviour from the previous year. As the value of your prospective customers isn’t known, it’s important to assess CLV based on more predictive observations such as number and duration of web sessions and breadth of search for products amongst others.

CLV shortcuts in customer acquisition

Keeping one eye firmly planted on the tenets of CLV calculation (1. Don’t treat all customers the same and 2. Do treat historic data as stale) – let’s look at 3 harmful customer acquisition shortcuts we encounter on a regular basis.

1. Treating new cohorts like old cohorts

The most common analytical shortcut is to relate the CLV of a new cohort to a prior cohort whose value is known. For instance, all new customers acquired last month via Paid Shopping assume the same 12-month CLV of the cohort from the previous year. This kind of coarse-grained approach brushes aside the 80:20 rule (tenet 1) and puts too much weight on a historical measure of CLV (tenet 2).

To remedy this approach, start by breaking your cohorts up into more granular segments. In addition to acquisition channels, consider segmenting cohorts by product category and geography. Taking a more granular approach will bring more valuable segments to the foreground.

You will get higher fidelity with better segmentation; however, you should remain skeptical about the reliance on historical CLV. As new cohorts progress, monitor their value generation over the medium term to make sure it remains on track with historical values. If this is not the case, then more statistically-driven approaches may be required. We will examine these approaches later in this post.

2. Regression to the mean

Marketing spend decisions will shape the value of your customer base over the long run. How well this is done can be the difference between growing your VIPs or not. Because when you spend based on averages, there’s a tendency over time to acquire average customers who are worth little more than you spent on them. The figure below illustrates this point well.

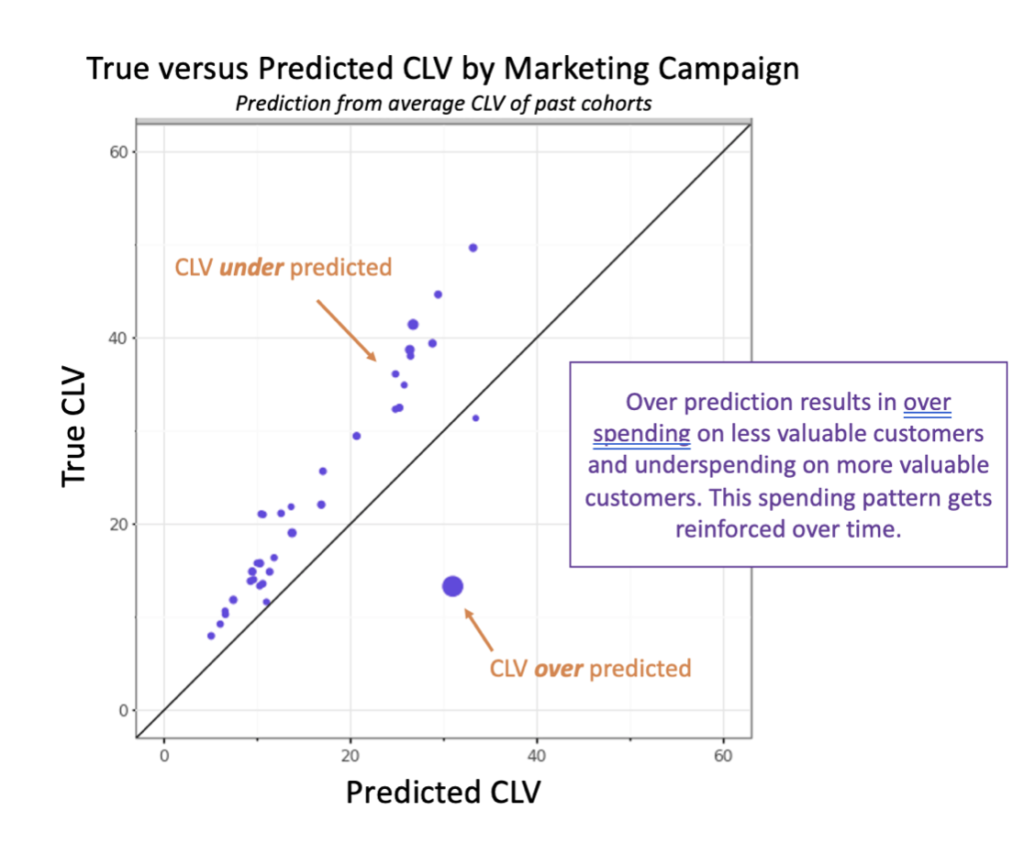

In this example an eCommerce brand utilised an averaged historic CLV to set spend for marketing acquisition campaigns. Each dot represents an individual campaign, with the size of the dot relating to the number of customers acquired. The closer these dots are to the diagonal line, the more accurate the predicted CLV was to the truth.

Note how few of the campaigns were attributed with an accurate CLV – deviations of 50% are commonplace. Clearly using averaged historic CLV to allocate spend leads to both underestimating and overestimating the value of customers. Playing this approach out over time can siphon spend away from campaigns that bring valuable customers and towards those that bring lower value customers, eventually you might arrive at a place depicted in the figure where a single campaign is limiting all progress.

3. Over reliance on lookalikes

Tools for targeting more valuable customers have advanced considerably over the years. Facebook’s lookalike audiences have long been a popular tool for marketers and in 2017 they started offering “value-based” lookalikes to broaden further the use case for reaching people similar to high-ROI customers. Google’s advertising tools offer similar capabilities.

It’s easy to see the appeal of “lookalikes” and indeed most marketers should probably be taking advantage of them; however, targeting alone is only one part of a CLV-based marketing strategy. If your tools for calculating CLV don’t adhere to our key tenets, then you’ll be blind to the actual effectiveness of your lookalike campaigns. Our advice: Don’t fall into the trap of thinking that optimising your lookalike settings is your silver bullet!

Moving away from average historic CLV

Getting a handle on predicting CLV requires a customer-centric approach. Factors like acquisition channel, geography, and product choice give us a pretty flat view of the customer base in practice. Other readily available details in customers’ journeys are usually far more predictive: number and duration of web sessions; breadth of search for products; use of the shopping cart and abandoned items; returning to checkout with a promo code; etc.

Working with these additional data points demands a more statistically-driven, machine learning approach. The payoff comes in far more accurate predictions. Compare the predictions in the figure below obtained with a machine learning model of CLV to those in the previous figure obtained with an averaged historic CLV. One of our customers recently switched over to this new predictive model and they immediately identified 42% of their acquisition budget could be better spent.

If you do decide to implement this yourself, do let us know what kind of success you are seeing. As we roll ML-based approaches out to future customers, we’ll update this post with real world use cases where we’re seeing a significant uplift.