Me vs. The Market: Black Friday Is Not the Investment It Once Was

Our monthly Me vs. the Market segment pulls data from 1000s of businesses to provide key insights for e-commerce professionals and industry observers looking to benchmark and understand the digital commerce ecosystem

Key definitions:

- Return On Ad Spend (ROAS): the amount of revenue earned for every dollar spent on advertising

- Customer Acquisition Cost (CAC): the amount it costs to acquire a new customer.

- Customer Lifetime Value (LTV): average amount that a customer spends over the first 12 month period.

- LTV:CAC Ratio: Customer lifetime value vs. Cost of Acquiring Customers. In other words how profitable a customer is over their lifetime.

Black Friday – you know the deal. It’s an event with a reputation for huge discounts and hoards of new customers, not to mention it’s shelf clearing potential. In truth, e-commerce businesses are no longer getting the same bang for their Black Friday buck.

This is due to an unfortunate combination of rising CAC during this period as well as consistently poor repurchase rates from the customers it acquires. While businesses can still enjoy a healthy revenue bump from this event, as a long-term strategy for growth Black Friday is simply not the investment opportunity it used to be.

This analysis looks at the performance of Black Friday campaigns (from 19-30 November) for e-commerce companies across multiple categories between 2018 – 2020; by examining CAC, ROAS and LTV for customers acquired during this period.

- Black Friday will still provide a return on ad spend

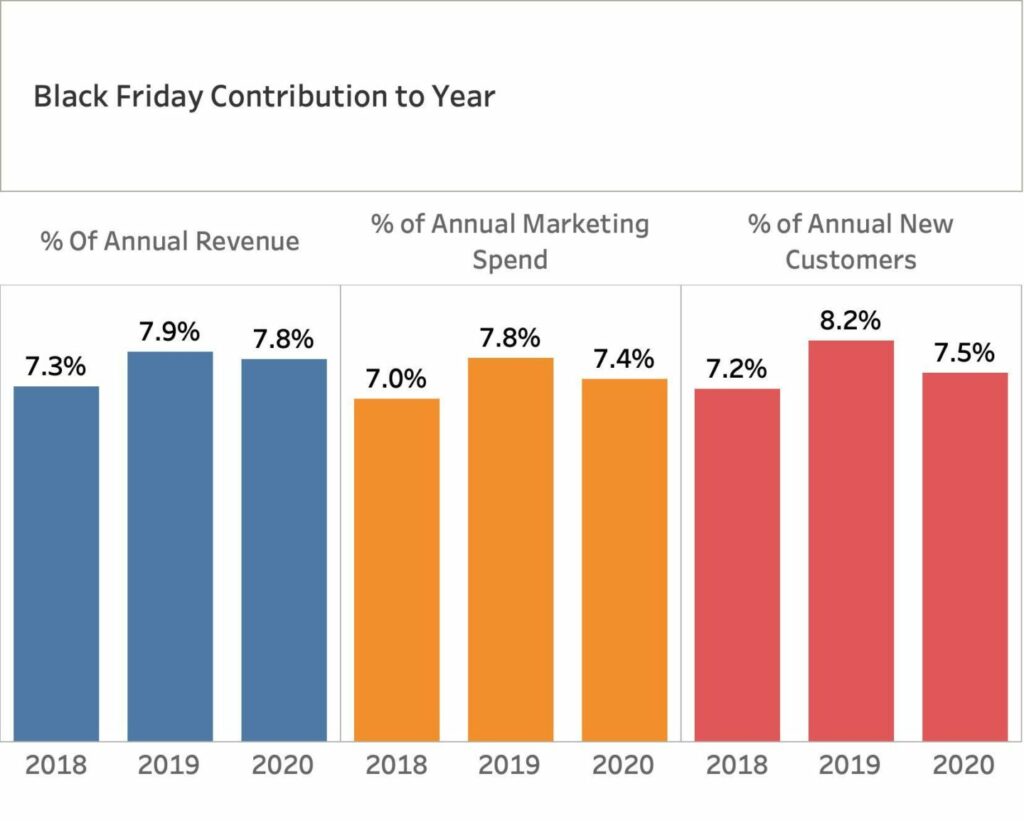

Average return on ad spend (ROAS) for Black Friday has decreased over the past three years, falling from 46.1% higher than other times of year in 2019 to 28.7% in 2020.

Despite this downward trend, Black Friday is still worth investing in as it’s responsible for approximately 8% of revenue for the year with revenue peaks 3 – 4x bigger than the average day.

So while Black Friday has the potential to drive excess revenue for businesses, that payoff is decreasing over time.

- Black Friday customers are more expensive to acquire

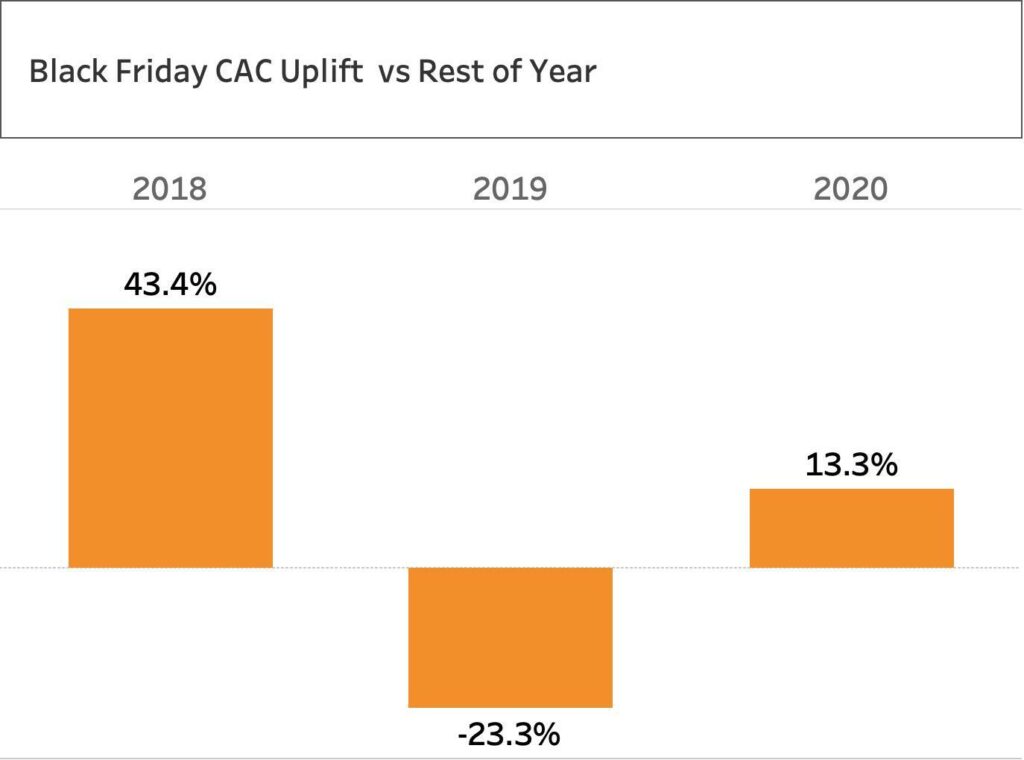

With customers primed to pounce on these seasonal discounts, Black Friday through Cyber Monday, can be a powerful period for acquisition. However, customer acquisition costs (CAC) for this week were also 13.3% higher in 2020 than other times of the year (Calculated on Paid Search and Social), with all businesses vying for the same Black Friday bargain hunters.

With the pandemic paving the way for more e-commerce businesses to take root, and auction based ad platforms thriving off the increased competition, you can bet your bottom line that each click will cost more than the last. This increased cost of acquisition may be worth it if the new recruit becomes a loyal customer. If they don’t, the investment has been costly.

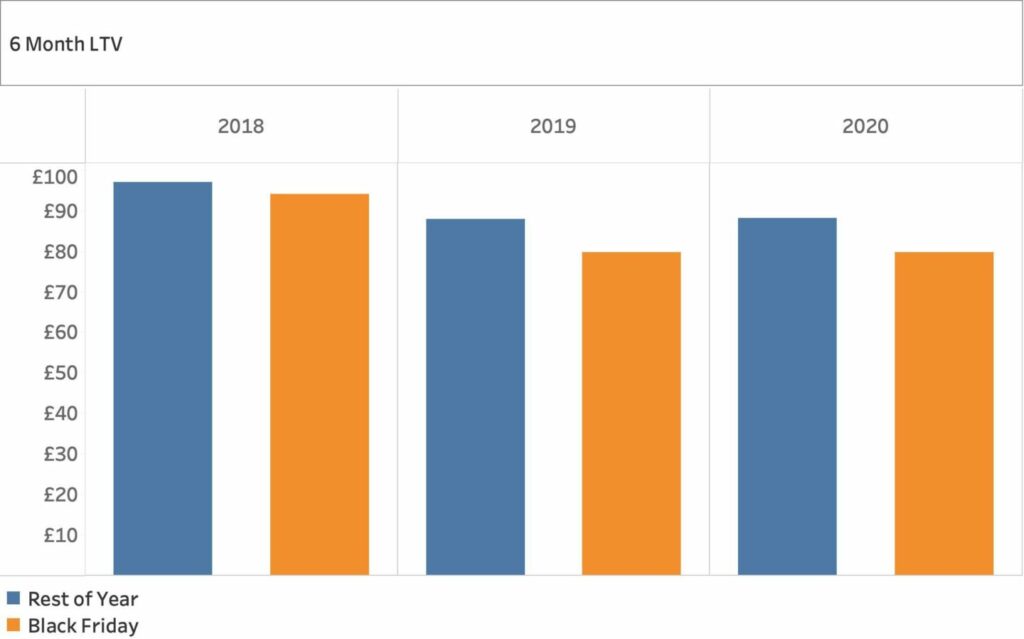

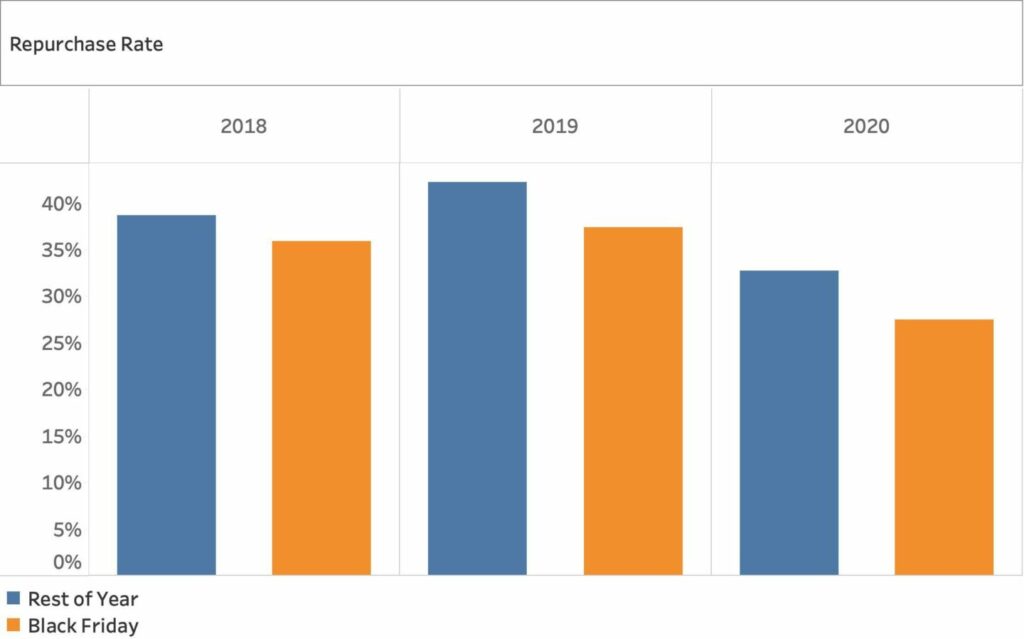

- Black Friday attracts lower value customers

Although Black Friday is a powerful tool for attracting new customers – all customers are not equal in value. In fact, these seasonal discount-driven buyers have a 9% lower 6 month LTV than those acquired during the rest of the year, meaning they have a tendency to quickly burn and then churn.

Their repurchase rates are also consistently 5% worse depending on category and the gap is widening as this continues to decline. By analysing previous customer data retailers can predict their likely return on investment from these customers before deciding how heavily to discount items and improving profit margins as a result.

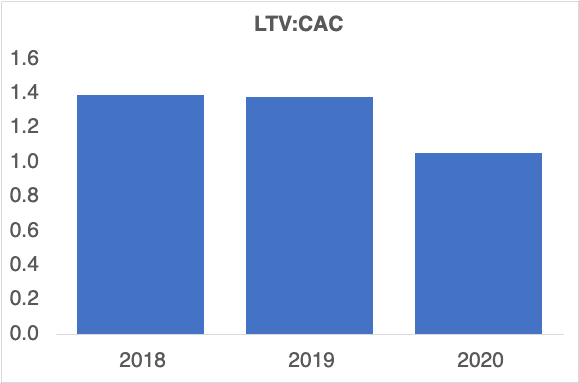

- Black Friday is becoming less profitable

The Black Friday event is becoming less worthwhile to invest in, with a worsening trend in LTV:CAC ratio for all paid channels. In other words, this event brings in poor quality customers, who do not come back to purchase again, and are also increasingly expensive to acquire in the first place.

As customer buying intent is high during Black Friday, we don’t advise withdrawing from this activity altogether, but we do suggest you proceed conservatively and measure aggressively during this period.

How to approach Black Friday

Black Friday is becoming less and less valuable as acquisition costs soar and new customers fail to buy another day. To add insult to injury, this Black Friday amidst the continuing pandemic, chaos of Brexit, supply chain disruptions and inflation, customers are still expecting compelling discounts.

Given these circumstances and their negative impact on CAC, retailers should use discounts to strategically clear shelves of aging or unpopular stock ranges. They might also try additional cost-free incentives such as the doubling of loyalty points for purchases made on that day.

It’s hard to say when Black Friday will generally become more hassle than it’s worth and likely impossible to judge its viability before plopping down your hard earned marketing budget. The only way to stay ahead of this downward trend is to keep a firm eye on your ROAS, CAC, LTV and of course your LTV:CAC ratio.

At the end of the day, Black Friday is still an undeniably important event for bringing in new customers and their cash; presenting an opportunity for driving retention as well as short-term revenue goals.

As an e-commerce performance accelerator, Conjura helps brands to identify, understand and execute on their most impactful opportunities by analysing business performance against industry benchmarks to inform strategy and drive growth.

Through our lens, companies can quickly and easily understand whether their approach and spend for events such as Black Friday are driving OR draining their business of its lifeforce!