All customers aren’t created equal…facts! Some show up once, snag a discounted hoodie, and vanish forever. Others become brand loyalists – buying your new product drops, clicking emails, and telling their friends about how great you are. The million-dollar question? How much is each customer actually worth to your business over time?

Lucky for you, there’s actually a term for this: Customer Lifetime Value (LTV) or (CLV) – a valuable metric that tells you just that.

In this article, we’ll break down:

- What is Customer Lifetime Value (LTV)?

- How to calculate Customer Lifetime Value (with examples)

- Why LTV is crucial for scaling your eCommerce brand

- Common mistakes (and how to avoid them)

- LTV calculators and tools you can use

Let’s get into it! 👇

What is Customer Lifetime Value (LTV)?

Customer Lifetime Value (LTV), also referred to as CLV, is a prediction of the net profit your business can make from a customer over the entire duration of their relationship with your brand.

Put simply, it’s a forecast of how much revenue a typical customer is going to generate before they churn.

Understanding LTV isn’t just a vanity metric. It affects everything from how much you should be spending on ads, to how you should price your products, to how you design your loyalty programs.

At Conjura, we help brands go one step further than just calculating LTV. We combine LTV with CAC (Customer Acquisition Cost), repeat rates, SKU-level profitability, and contribution margins to drive laser-focused marketing and merchandising actions.

Why LTV is Important for eCommerce

If you’re not tracking LTV, you’re running your business in the dark. You might get away with it in the short-term, but if you truly want to maximize profitability and drive growth, then LTV is your best friend.

Here’s why understanding and optimizing your Customer Lifetime Value matters:

1. Smarter Marketing Spend

Let’s start with the basics: your LTV to CAC ratio (Customer Lifetime Value to Customer Acquisition Cost). This ratio tells you whether your marketing efforts are actually profitable over time.

If your average LTV is £100 and you’re spending £20 to acquire a customer, great news, you’ve got room to scale profitably. But if your CAC creeps up to £50 and your customer is only worth £40 long-term… well, that’s not a marketing strategy, it’s a leak.

Tracking LTV helps you allocate your marketing budget more effectively, prioritising channels, campaigns, and tactics that drive high-value, loyal customers – not just one-time buyers who disappear after their first purchase.

Thankfully, Conjura combines SKU-level ad spend and channel attribution to show exactly which campaigns are driving the best long-term returns, not just the flashiest ROAS.

2. Better Customer Retention Strategies

A low LTV isn’t always a marketing problem. Sometimes, it’s a retention problem in disguise.

By diving into post-purchase behaviour, repeat rates, and order frequency, you can identify exactly where customers are dropping off and, more importantly, why.

For example, maybe customers love their first order but never return. Is the product quality slipping? Is your email marketing falling flat? Is your delivery experience hurting loyalty?

The good news: once you spot the pattern, you can fix it. Launch loyalty programs, tighten up post-purchase comms, improve packaging – whatever it takes to keep customers coming back and spending their cash!

This is where Conjura’s New vs. Existing Customer dashboard really shines. It helps you track repurchase rates over time, measure the impact of changes, and calculate the ROI of retention strategies.

Remember: retained customers don’t just boost LTV, they also cost less to re-engage and often spend more per order. They’re the gift that keeps on giving (metaphorically and financially).

3. Product-Level Insights

Every product is slightly different. Some are high-margin customer magnets. Others just attract deal hunters who never come back.

That’s why Conjura ties Customer Lifetime Value back to the products in the customer’s first purchase.

Here’s what this tells you:

- Which products are bringing in customers with high LTVs

- Which items lead to high repeat purchase rates

- Which SKUs are underperforming despite solid sales

With this insight, your teams can make merchandising and pricing decisions with confidence:

- Promote the products that bring in loyal customers

- Bundle or upsell lower-value products with high-LTV heroes

- Rethink how you handle discount-led acquisition

With the right customer lifetime value formula, you can stop chasing short-term wins and start building long-term profitability.

4. More Accurate Forecasting

Truly understanding LTV unlocks the ability to predict future revenue. It’s not magic, it’s just maths (and a bit of Conjura wizardry, of course!).

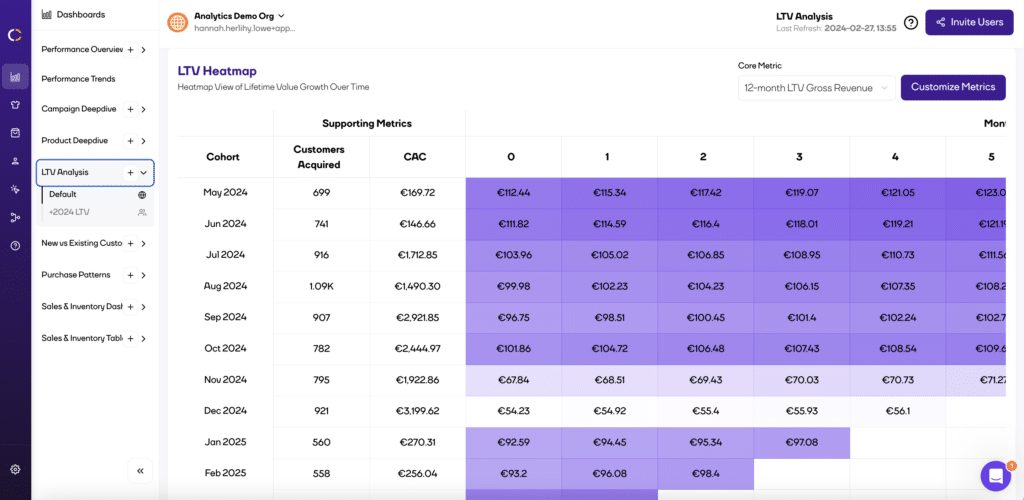

By analyzing customer cohorts and tracking CLV over time, you can forecast:

- Expected revenue from recent acquisitions

- The ROI of future marketing campaigns

- Inventory needs based on long-term purchasing patterns

- Cash flow projections for investor conversations or operational planning

If you’re scaling a DTC brand and looking to raise capital or secure funding, investors love to see solid LTV:CAC ratios. It’s a sign that your growth is sustainable, not just artificially fueled by ad spend.

And if you’re planning a big inventory investment? LTV data helps you avoid stockouts and overstocking (saving your business ALOT of money) by matching your product offering to your most valuable cohorts.

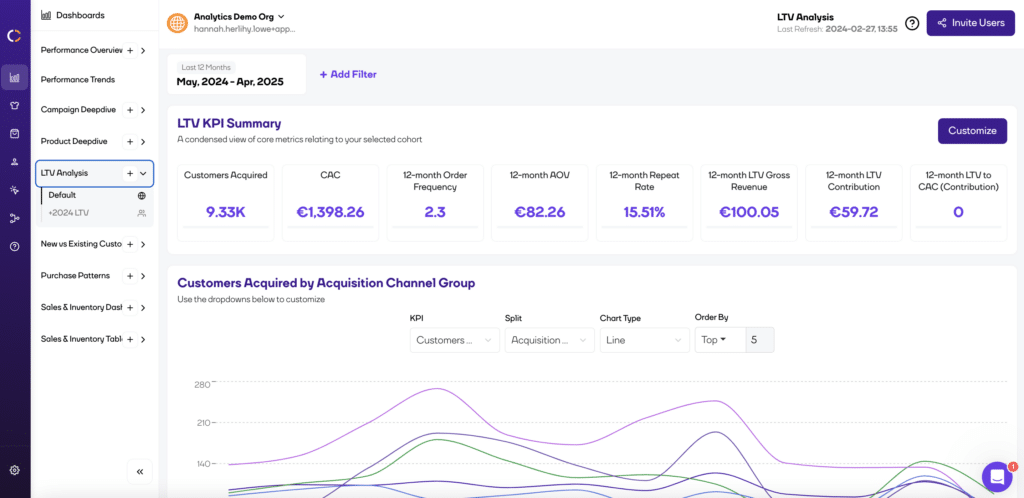

FYI: Conjura’s LTV Analysis dashboard includes 12-month cohort LTVs, repeat rate curves, and even LTV to CAC metrics by acquisition channel – so you can go from “gut feel” to data-backed decisions.

How to Calculate Customer Lifetime Value

There are a few different ways to calculate LTV, depending on how detailed you want to get. Let’s start simple and work our way up.

Basic Customer Lifetime Value Formula:

LTV = AOV × Purchase Frequency × Customer Lifespan

Where:

- AOV = Average Order Value

- Purchase Frequency = How often they buy

- Customer Lifespan = How long they stick around

Let’s do a quick example:

- AOV = £50

- Purchase Frequency = 3 orders/year

- Customer Lifespan = 2 years

👉 LTV = £50 × 3 × 2 = £300

A bit of a pain in the a** right? Luckily for you, Conjura can do it even better.

Conjura’s Advanced LTV Model

The Conjura platform calculates LTV over a rolling 12-month period with deep cohort-level granularity. Here’s the more accurate Customer Lifetime Value formula we use:

LTV (Gross Revenue) = Total Revenue from cohort / Number of customers in the cohort

Want profit, not revenue? We’ve got that too:

LTV (Gross Profit) = (Total Revenue – Total COGS) / Number of customers

And to get a handle on marketing efficiency:

LTV:CAC Ratio = LTV Gross Profit / Customer Acquisition Cost

This ratio is the crème de la crème of metrics, showing how much profit you’re getting back for every £1 spent on acquisition. A healthy LTV:CAC ratio is generally considered to be 3:1.

If it’s lower than 1:1… Houston, we have a problem.

Calculate CLV with These Tools

You can calculate LTV manually, but we know most eCommerce teams don’t want to be buried in spreadsheets. Here are some tools to help:

1. Conjura

Our LTV dashboards track customers over time, show repeat behaviour, and even tie LTV back to the product in their first order. You get insights like:

- 12-month LTV by cohort

- Repeat purchase rates

- Product-specific LTV

- LTV:CAC performance by channel

2. Basic LTV calculators

Many free LTV calculators are available online (just Google “LTV calculator”). These are fine for quick-and-dirty numbers but won’t give you profit-level clarity or product attribution.

3. Lifetimely / Shopify apps

Some analytics tools offer predictive LTV models, but keep in mind, they often rely on limited data and don’t tie LTV to SKU or campaign-level metrics like Conjura does.

What Impacts LTV?

Here are the biggest levers you can pull to increase your Customer Lifetime Value:

1. Improve Repeat Rate

The more frequently people return, the higher their LTV. Loyalty programs, replenishment reminders, and excellent post-purchase experiences can all help. Want some extra tips on enhancing your Customer Adoption Strategy – check out our latest partner micropaper here.

2. Increase AOV

Bundling, upsells, and free shipping thresholds encourage customers to spend more per order.

3. Extend Customer Lifespan

This one’s about brand connection. Think community, exceptional service, and relevance. What makes people keep coming back after 6 or 12 months?

4. Smart Segmentation

Some products or acquisition channels bring in high-value customers. Others don’t. LTV segmentation helps you double down on what’s working.

Common Mistakes in Calculating LTV

- Using revenue instead of profit: Your margins matter. Always factor in COGS, shipping, refunds, and discounts.

- Ignoring cohort behaviour: Not all customers behave the same. Lumping them together hides what’s really going on.

- Forgetting timeframes: Lifetime value isn’t forever. Use realistic periods (e.g. 6 or 12 months) for actionable analysis.

- Failing to tie LTV to CAC: If you’re not comparing LTV to acquisition cost, you’re not seeing the full picture.

Wrapping Things Up

Understanding how to calculate Customer Lifetime Value isn’t just about data. It’s about building a smarter, more profitable business. Whether you’re optimizing ad spend, choosing what to discount, or deciding which products to push, LTV gives you the “so what” behind your data.

And if you want to go from spreadsheet stress to strategic success? Conjura’s your best friend.

Our LTV dashboards are part of a suite of analytics tools that give you the full view of profitability, performance, and customer behaviour – so you can turn data into profit.

👉 Book a Conjura demo or explore our free trial.