Rising adoption of benchmarks in D2C businesses

Why are more and more ecommerce tech businesses adding benchmarking to their product offering?

Shopify recently went live with a benchmark solution that they had previously utilised with their customer success team on calls with their customers, predominantly Shopify Plus customers. In addition, lending platforms like Wayflyer have added a benchmarking freemium offering. This comes on the back of established ecommerce benchmark tools such as Conjura and Varos hitting the market in early 2022 and analytics tools such as Triple Whale recently incorporating benchmarks across their UI. Why the sudden rush to benchmarks? What has changed?

Below I will attempt to address some of the key factors that have led to this recent phenomenon.

- Homogenisation of retail platforms. Benchmarking has existed within the consulting world for years but was limited to larger retailers who could afford hefty fees for consulting firms such as Bain, BCG or McKinsey to assess their performance and strategy. Advisory firms such as More2 offered a similar solution to mid market retailers but again the pool of data was limited in size and the process quite manual. The arrival of cloud based tooling such as Shopify, Woocommerce etc has led to millions of retailers across the world sharing an identical technical stack for the first time. The ease of extracting data from these platforms through APIs has allowed companies with large access to retailers to quickly and automatically ingest all of their data and surface detailed KPIs that are directly comparable to hundreds of thousands of other similar retailers across the globe. Thus a supercharged benchmark capability was born.

- The comparison pools. This reinforces the point above but bigger sample sizes coupled with multiple filtering options has resulted in more specific and more meaningful comparisons for all operators. If an operator in the UK selling shoes at between £100-£150 per pair, generating a turnover of £5m-£10m, and spending £1m-£2m on Meta advertising wants to compare themselves with a similar cohort this is now possible. Historically many operators have been dubious about the comparison pool and therefore would never take the comparison that seriously.

- The emergence of a more data driven approach. Better and better data tooling has democratized high end data analytics for even the smallest of companies. This has resulted in the most sophisticated of approaches, typically adopted by hedge funds spreading across other disciplines and industries. Savvy investors, such as hedge funds have always measured relative performance of companies to the market as well as measuring the collective performance of the market itself through the use of alternative data. These techniques are now available to individual D2C operators, who are slowly learning how to apply them to day to day decision making.

- Educating the market. Still to this day many retailers don’t understand the value of benchmarks and are unable to generate tangible actions from even the best of benchmark solutions. However, this is changing. More and more tools are incorporating benchmarks and sharing success stories of how operators utilize them successfully in practice. The early adopters are helping to educate everybody else. Below we have highlighted three examples of how benchmarking can be used effectively by ecommerce operators.

- Higher frequency of use. Historically benchmarking was part of a consulting service that a company might utilise once a year in advance of a strategy session. Now benchmarking can be adopted daily, weekly or monthly at a low cost and therefore is more likely to become part of the measurement toolkit that operators use.

What are the best practical uses of benchmarks for operators?

- Revenue Mix (or Marketing Spend Mix) - Comparing your revenue mix by channel or sometimes marketing spend mix by channel against similar companies can help identify new channels to consider or to allocate more resource to. Benchmarking can confirm that a given channel is effective in a particular target market.

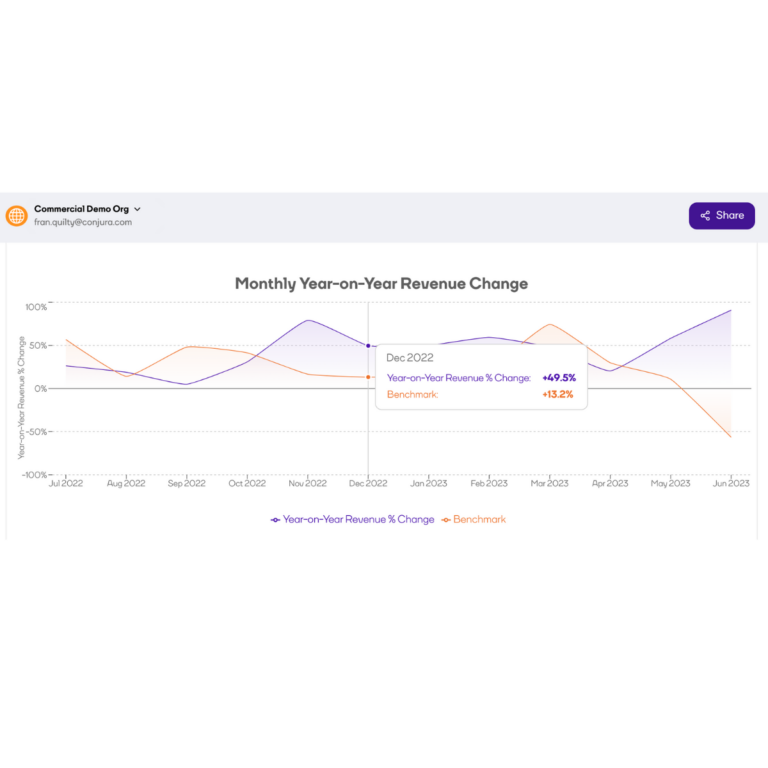

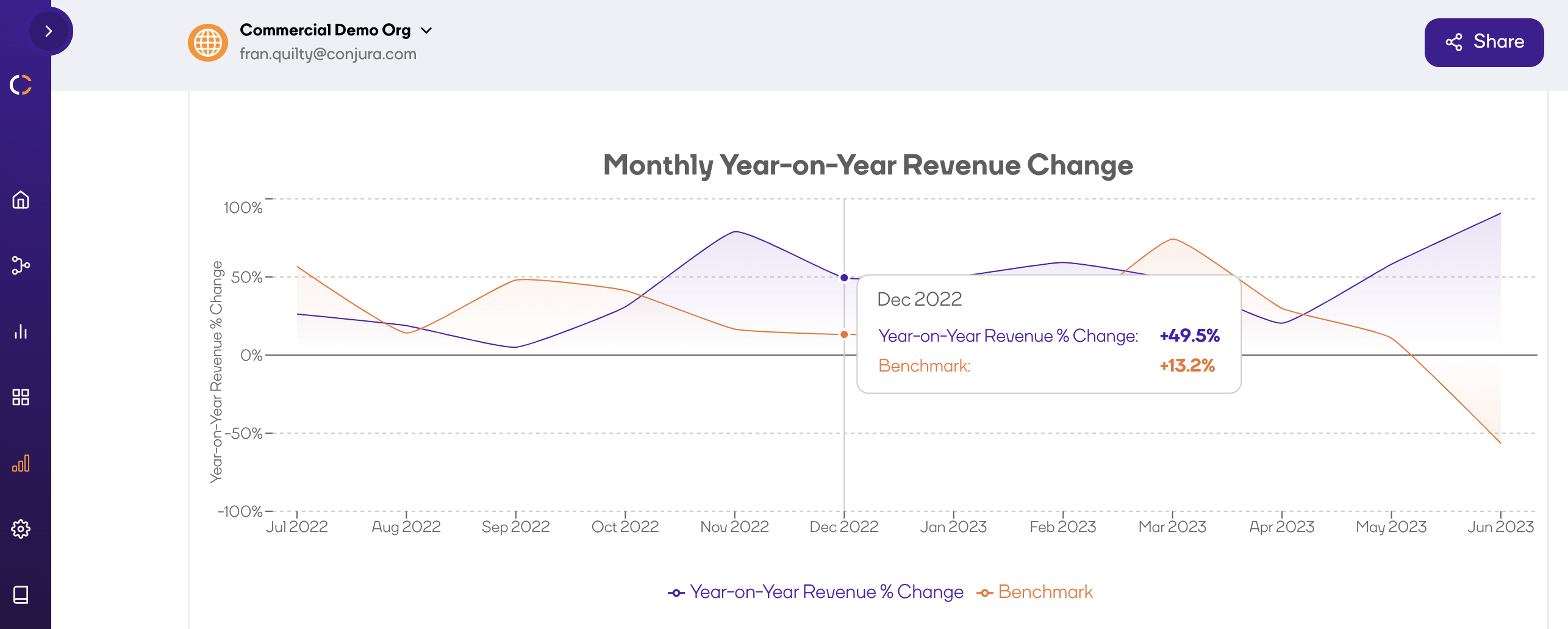

- Marketing Performance - Comparing KPI’s such as ctr, cpc or cpm on paid channels will allow operators to understand whether recent improvements or declines in marketing performance are specific to them or more as a consequence of changes in the wider market. A recent Meta glitch resulted in a drastic drop in performance for one day in April (CNBC). Those retailers that were monitoring relative performance would have understood that the inflated cpm was ubiquitous and nothing that they could control.

- Internationational Expansion - When initially entering new markets it can be very useful to understand the specific revenue mix of that new territory or change in KPI’s of that territory to help forecast performance and relative growth expectations over a certain time period.