After the volatility of 2020 and 2021 lockdowns 2022 was supposed to be a more predictable, normative year for retailers. Unfortunately, the opposite is true. Although supply chains complications have subsided the war in Ukraine has led to a spiralling of energy costs and a subsequent rise in interest rates and inflation.

On top of this, consumer behaviour in 2022 has seen a renewed emphasis on experiences, particularly foreign holidays to make up for the barren Covid years of travel. This spend on experiences has taken precious discretionary cash away from consumer goods. Finally, as if things weren’t already gloomy enough, many eCommerce brands have ordered excess stock as a result of getting caught short of stock during the busy Q4 in 2021.

What do we think will happen over the next 12 weeks? We have decided to use our anonymised benchmarking data to highlight four interesting trends leading up to the peak trading period.

Buying behaviour is clustering more around Cyber week

Over the last three years a higher concentration of purchases has occurred throughout Cyber week, cannibalising revenue from the weeks preceding and following Cyber week. This raises lots of questions around marketing budget allocation for all of Q4, in addition to discounting strategy for the key dates of Cyber week. I would suggest retailers plan for more of the same or even more pronounced behaviour this year when planning marketing activities.

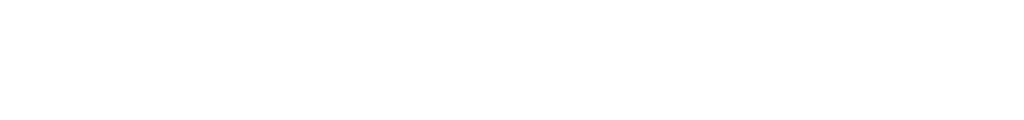

Some countries are suffering more than others

2022 has been a tough year for retailers all across the globe. eCommerce growth has slowed in comparison to 2020 and 2021 but certain regions are affected more than others. According to the Conjura benchmarking tool the UK has seen negative revenue growth in eCommerce across all months in 2022.

In contrast, the US has seen positive revenue growth in eCommerce throughout 2022, culminating in an average increase of 15% year to date. Europe has been a mixture of months with good growth and months with negative growth in 2022. The trend for the UK looks like it may continue through to the end of 2022 based on macroeconomic headwinds whereas companies in the US and Europe should expect minor growth in Q4.

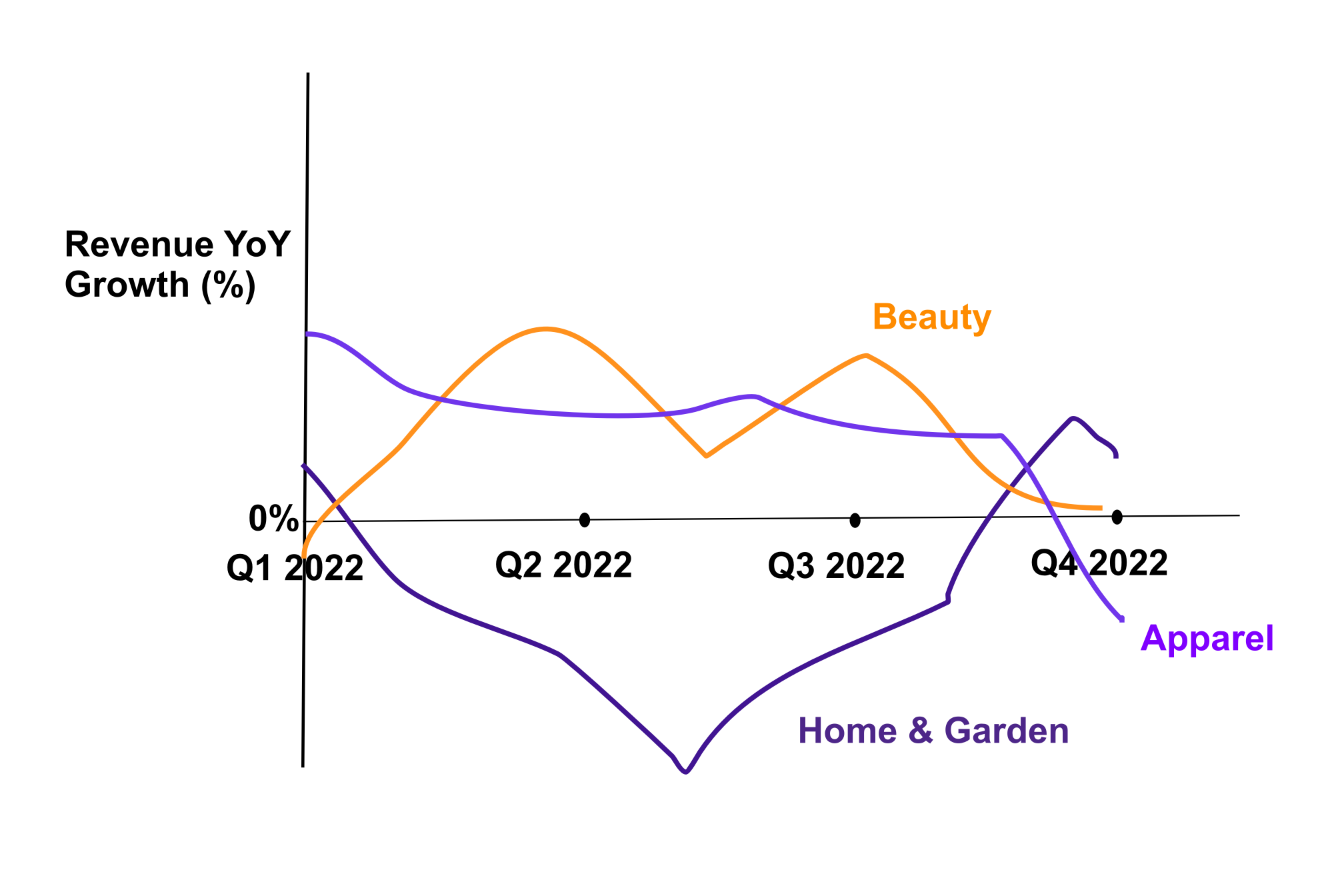

The return of bricks and mortar affected some verticals more than others

Covid 19 lockdowns led to a massive shift in online purchases across all verticals. As physical stores have reopened some verticals experienced a bigger drop in online sales than others. Home and garden was affected in particular, which is not surprising considering the nature of the products. Beauty has been the least affected vertical to a drop in online revenue in 2022, although the average discount in 2022 has increased for the beauty vertical.

Paid marketing trends differ across the regions

The average CAC (customer acquisition cost) for eCommerce companies using Google Shopping has increased steadily throughout 2022 for US businesses but has gradually decreased on average for UK businesses. In contrast paid Facebook and Instagram CAC has decreased for parts of 2022 in the US but has increased throughout 2022 in the UK.

What should brands do to maximise growth?

Strategic decisions need to be made on marketing spend, discounting, CRM activity etc. on a daily basis throughout October, November and December. Utilising a benchmark tool can help businesses spot trends in the market and react to initiatives that may be working well for other businesses in their own vertical or in their own territory.